Future of F&B in Stadiums: Experiences Not Just Entertainment

Foreword

Stadium owners and operators are placing more and more value on the maximisation of the fan and guest experience. Delivering an engaging environment for all supporter segments is crucial in driving the performance of a stadium. The food and beverage (F&B) segment is a key element of this. F&B has to be at the heart of the match and non-match day experience. It is not just the food product itself, but the F&B experience as a whole which is of paramount importance.

The premise that F&B is an integral element to the fan experience must be embraced in an early stage of the planning process, to ensure revenue maximisation as well as efficiency of operation within the F&B function. It is therefore important to ensure that the best resources or partner(s) are involved at the initial planning stages of a new stadium development. Successfully delivering F&B is a highly complex task, where not only is there a need to understand different customer demands to be met, but also to align the infrastructure and guest spaces with the requirements of the customer.

As part of our commitment to help venue operators deliver exceptional guest experiences, Ground Control Global recently conducted a survey to see what sports fans value most in their stadium experience. Based on the results, we identified four key areas that would equip stadiums to become better and more profitable venues.

- Providing social spaces that Gen Y and Gen Z are used to interacting with

- F&B in-seat service to unlock the ‘holy grail’ of service and revenue

- Outsourcing premium spaces to high-street hospitality groups

- Not breaking the value chain and making it work for you

1. Providing Social Spaces that Gen Y and Gen Z are used to interacting with

At a glance…

- Aside from expecting an exciting game (72%), fans – specifically Millennials – look for experiences provided by stadiums, especially great food (43%) and drinks (33%).

- In fact, Gen Z ranks socialising with friends as the second reason for attending a sport event apart from the game itself.

- 59% of Gen Z plan a pre- or post-event get-together.

- 65% of Gen Z make purchases specifically for the event

- 68% share the experience on social media

Source: Facebook Fan Survey

There is a whole new potential audience who simply want to buy the cheapest ticket to get access to the venue’s purpose-built social spaces. The stadium experience is evolving to one that is about much more than the traditional objective of merely filling seats. Millennials do not want to be tied to seats as this is not how they interact with each other in other forms of entertainment. Millennials instead regard the stadium as the place to be: it’s a place to hang out, be seen and be social.

This is great news considering stadiums traditionally struggle with the limited time periods within which they can sell food, and the huge volumes of people who want to be served in this precise window. Encouraging fans to arrive with plenty of time before games start not only increases the potential to drive more sales but also eases the strain on caterers to serve tens of thousands of fans. We already see a trend where stadiums are transformed into entertaining and interactive spaces providing plenty of F&B options.

1. Miami Freedom Park, US

The stadium features 58 acres of true open-access green space, providing an oasis for the local community to hang out. The precinct also hosts local and national retailers and restaurants, and a 750-room hotel will serve surrounding residents and attract visitors year-round.

2. Tottenham Hotspur Stadium, UK

The concourse offers 30 bars, 15 eateries and four member clubs, along with three pub-style feature bars. Open before and after matches, The Market Place is designed to create a feeling of unity and a sense of anticipation among home supporters, with the excited hum of pre-match activity rising through the stunning five-storey atrium setting and spilling out into the stadium bowl.

The Market Place, situated in the stadium’s South Stand, Touchline Grills and Tap Inns, located throughout the venue, offers a wide range of traditional fan favourites and other delicious dishes inspired by London’s vibrant street food market scene.

2. F&B in-seat service to unlock the ‘holy grail’ of service and revenue

At a glance

- A key finding that surfaced was that accessing food and drinks without having to leave seats would be the best way to enhance the stadium experience, with 70% of fans selecting in-seat service as their top choice for improved customer service, followed by quicker transaction times (20%) and the ability to order from anywhere in the stadium (10%).

- 10 minutes is the average time that fans were willing to wait in line for food and drinks. However, 18 minutes is the total amount of time at an event the average fan currently spends in line at concession stands.

- 40% of fans have abandoned concession lines at least once in the past 12 months without making a purchase because the wait was too long.

- The average Australian fan spends $28 per game at concession stands. However, fans also indicated that they will spend more if their F&B experience improves.

The Fan Experience Report: What do Fans Want (Oracle, 2016)

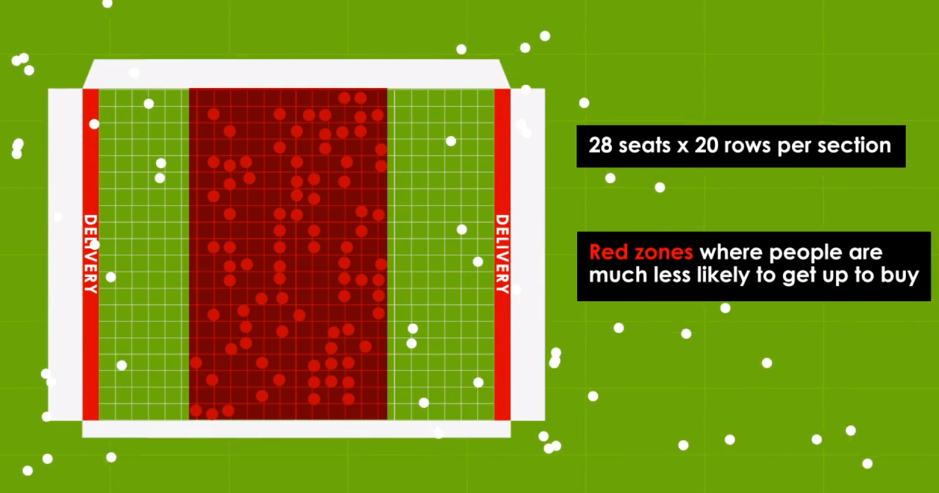

Fans made it emphatically clear that in-seat ordering is an attractive option because they don’t want to miss crucial moments in the game, which often prevents them from making more F&B purchases. While in-seat F&B is currently Australian sports fans’ number one want, traditional stadiums are not designed to accommodate space flexibility. A rethink is required to overcome barriers: how to serve middle seats and capture these massive revenue opportunities?

With average attendance in Australia around 40% of capacity and only 10% of games selling out, imagine a stadium with modular seating that can be configured on demand. Removable and replaceable seats help to protect full events and Tier 1 status, while removing six seats per row at non-capacity events present lucrative revenue potential.

By adopting our approach and achieving projected uplifts in capture and spend, F&B revenue can increase by 30% in these zones.

3. Outsourcing premium spaces to high-street hospitality groups

At a glance…

- Our stadium patrons and sport fans interact with the high-street every day – they go to bars, restaurants and clubs run by operators whose DNA is designed around attraction, profitability and atmosphere.

- The stadium of the future will blend these operators into the mix; it’s already been happening in airports and other attraction spaces like shopping malls for quite some time – especially in Australia and the US.

- New stadiums will emerge with hospitality integrated in the design. Thinking beyond a bowl with a playing surface in the middle, stadiums will include a strong component of elevated F&B.

- Partnerships and commercial models will evolve to accommodate these operators. Stadiums cannot expect the traditionally high concession fees from these operators. They will inevitably use their own resources to drive attendance and fans to events

What do high-street operators bring to the table?

- A different perspective on attraction. They understand their target markets and pursue them relentlessly to open new reasons to come to the stadium.

Aramark, the concessions giant that won the contract to run catering operations at the new new U.S. Bank Stadium, made a few savvy connections with local chefs. The results redefine the gameday experience, advancing it in exciting new culinary directions. Aramark wisely recruited local talent along the lines of Andrew Zimmern, Gavin Kaysen and Thomas Boemer, and their approach to stadium fare is winning big time.

If having it all on one sandwich doesn’t hit a home run with you, there are several other new food options at the stadium from Braves’ food and beverage partner Delaware North.

- A ‘wow’-factor for the stadium and a focal point for social and marketing. Specialty food stands are being designed with foodie culture in mind.

At SunTrust Park, home to the Atlanta Braves, chef-driven eateries are set up by sought-after local restaurateurs, eschewing pickup windows for open-plan stands where fans can see food being prepared. The idea is to show fans the cooking and plating process, creating more of an experience around eating at the stadium.

If having it all on one sandwich doesn’t hit a home run with you, there are several other new food options at the stadium from Braves’ food and beverage partner Delaware North.

- Consistent execution and a sense of value. Offers and pricing are comparable to high-street venues.

Mercedes-Benz Stadium’s (MBS) award-winning F&B program is getting even better for the 2019 Falcons season. MBS added Atlanta brands like Holeman and Finch, Fred’s Meat and Bread, and Ponko Chicken among others. Stadium officials cite earlier arrival time by almost 10% of fan capacity as only one of many positive system-wide impacts that were by-products of the design, execution and service of the F&B program. 92% of fans attending Falcons games made a F&B purchase inside MBS in 2017, substantially increased from 2016. Moreover, the first-season F&B satisfaction ratings contributed to overall gameday satisfaction ratings of first in MLS and third in the NFL, up from 17th in the 2016 season.

- And as mentioned earlier They cross promote and will drive patronage for your venue.

4. Not breaking the value chain and making it work for you

At a glance…

- The stadium of the future will offer a range of F&B that can appeal to all. There will be a stronger focus on the value chain and ensuring there is something for everyone.

- Fans demand stadiums to provide a better food experience with improvements in quality, speed of service, variety and pricing.

- F&B capture raises can rise to the 80-90% range by following the value chain.

- Stadiums can and will pay more attention to value by increasing capture.

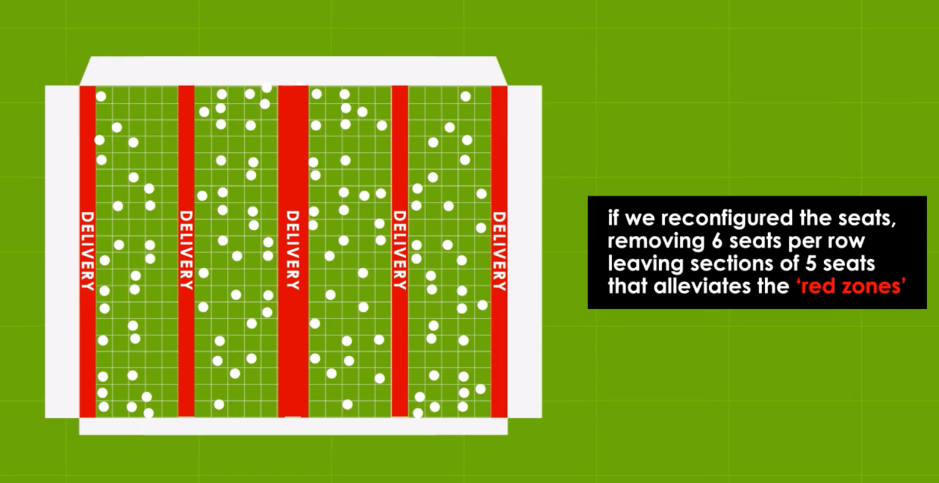

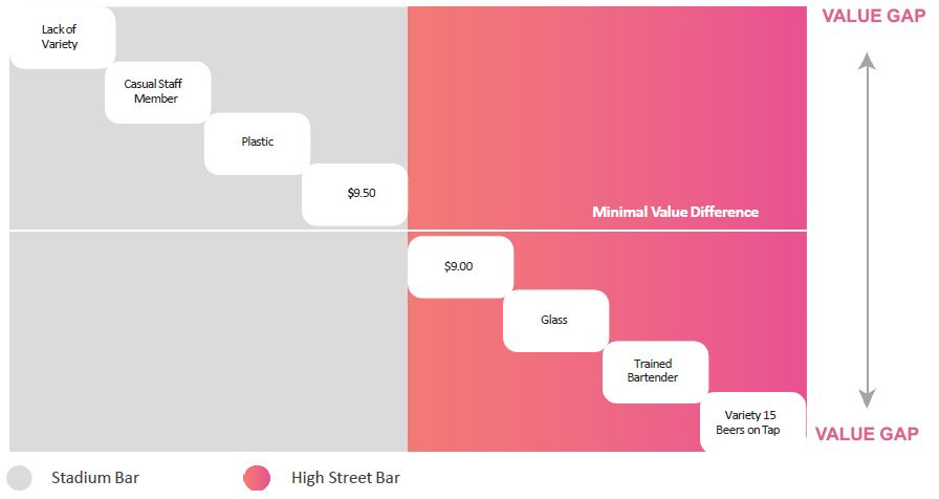

Today’s customers have more experience of eating out with an expectation of higher service. Customers are more discerning, especially in a challenging economy, and demand value for money. At premium levels, customers increasingly prefer informal to formal hospitality. Attendance at football matches can often be expensive compared to other leisure pursuits, thereby elevating expectation – especially in relation to F&B. Treating fans as captive customers is no longer acceptable. At the general admission and concession levels, people expect a higher quality ‘dining’ experience, following market trends like ‘gourmet’ street food vendors who are now leading the way.

Key Factors:

- Power of strong branded QSR and basic food – not everyone is an adventurous foodie – some customers still want only the basics.

- Test and learn – don’t cap what you think customers are prepared to pay – test the market and adapt accordingly.

- Clear messaging – value is difficult to define for new, bespoke offers.

- Value is comparable to the high street – don’t allow the value gap to grow across price, quality, variety and service.

- All-format bars – new formats trump seated, full-service meal offerings.

Hard Rock Stadium

Hard Rock Stadium, home to the NFL’s Miami Dolphins, uses the value chain across an assortment of private clubs, including some field-level spots featuring all-inclusive menus highlighted by grilled-to-order fillets and fresh seafood bars.

Conclusion

The customer’s F&B experience is critical to their overall perception of the stadium experience. Thus, a best-in-class F&B operation can be a key driver for success in a stadium, not just in terms of revenues generated but also stadium users’ perception of quality. Optimising this requires solid relationships with the right partners with the right expertise. If this is achieved and the guest experience and space flexibility is planned from the outset, satisfied customers – both on match and non-match days – will drive the F&B business forward. The involvement of specialists at the design and planning stages will enable the right spaces to be allocated for the F&B function to maximise customer flows, and the efficiency of the logistical aspects within the stadium.

Recent Comments